Free Mutual Fund SIP & Investment Calculator

Calculate SIP returns, lump sum investment growth, and mutual fund performance in seconds.

Plan smarter investments and achieve your long-term financial goals with accurate projections.

SIP & Lumpsum Calculator

Total Invested: ₹ 0

Total Returns: ₹ 0

Final Value: ₹ 0

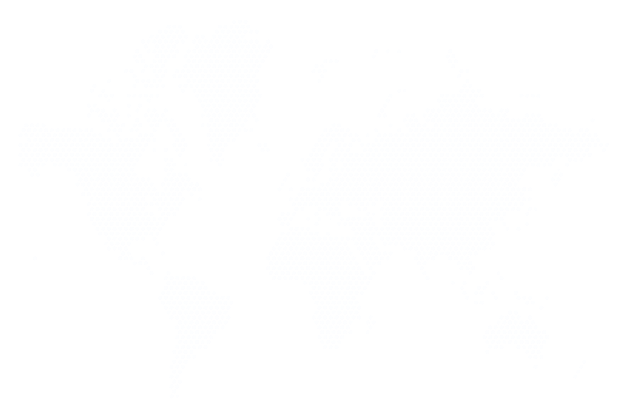

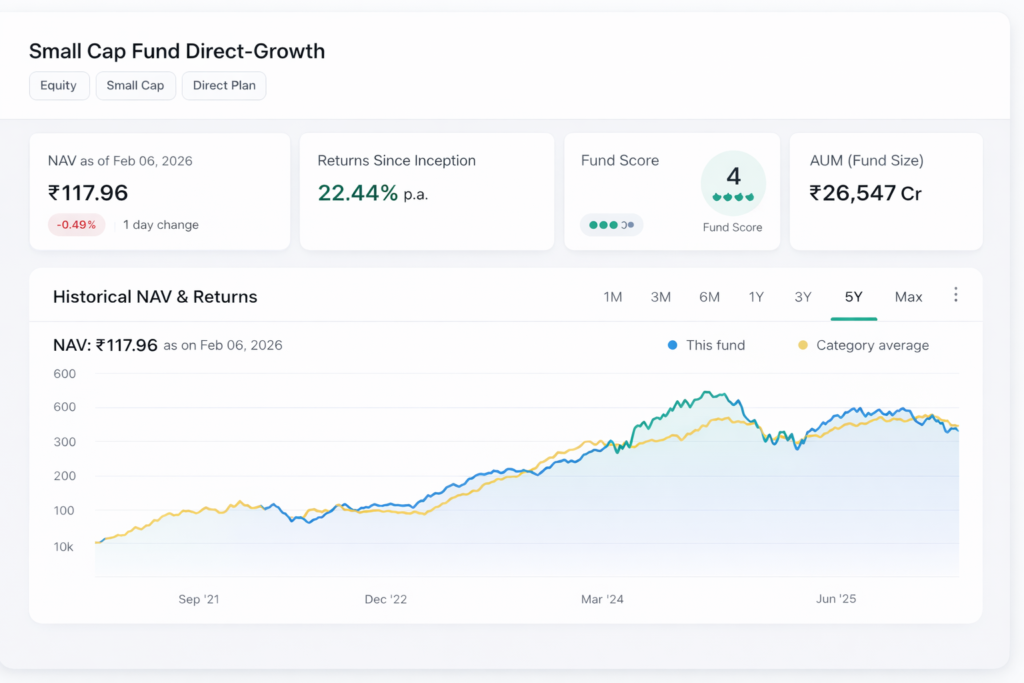

Track Your Investment Growth

Monitor your mutual fund performance with easy to read growth charts and return projections.

Understand Lumpsum or SIP returns, yearly gains, and total investment value at a glance.

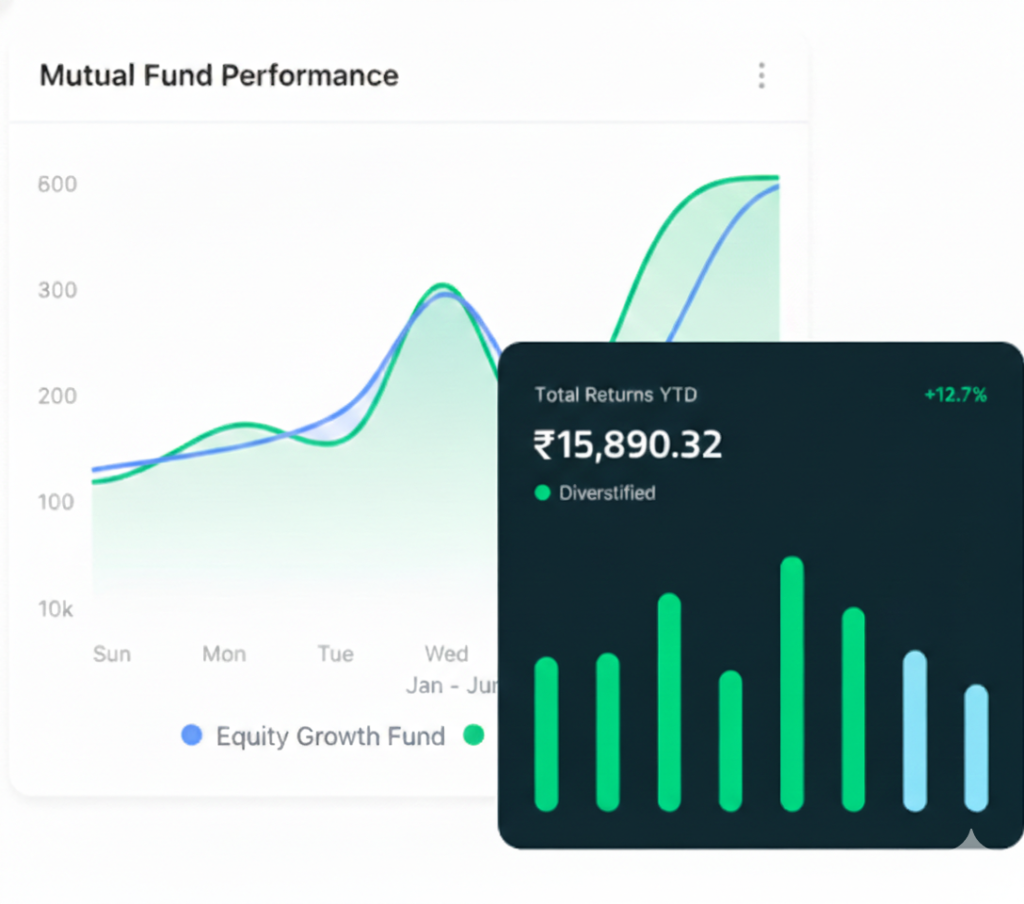

Find & Compare Top Mutual Fund Companies

Explore India’s leading Asset Management Companies (AMCs) in one place and discover trusted fund houses.

Compare investment options, start SIPs, and choose the right mutual fund partner for your financial goals.

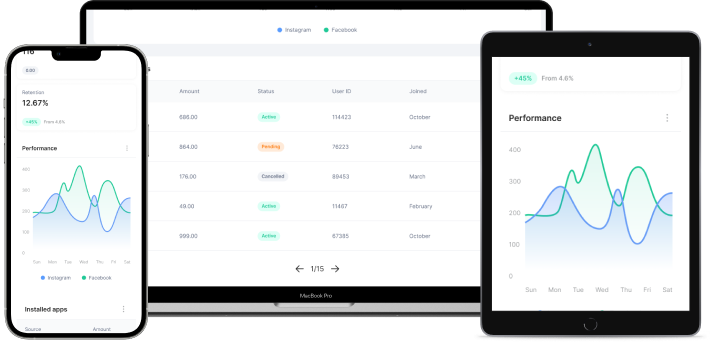

Accessible through all devices

Use our mutual fund calculators seamlessly across mobile, tablet, and desktop devices.

Plan SIP investments, track returns, and make smart financial decisions from anywhere.

Key Features

Powerful tools designed to simplify mutual fund planning and investment decisions.

Calculate SIP returns, compare funds, and track growth with ease.